3 Easy Facts About Matthew J. Previte Cpa Pc Described

3 Easy Facts About Matthew J. Previte Cpa Pc Described

Blog Article

What Does Matthew J. Previte Cpa Pc Do?

Table of ContentsSome Known Questions About Matthew J. Previte Cpa Pc.Little Known Questions About Matthew J. Previte Cpa Pc.The Buzz on Matthew J. Previte Cpa PcMatthew J. Previte Cpa Pc - QuestionsMore About Matthew J. Previte Cpa Pc4 Easy Facts About Matthew J. Previte Cpa Pc Described

Tax legislations and codes, whether at the state or federal level, are too complicated for many laypeople and they transform also frequently for numerous tax obligation specialists to stay up to date with. Whether you simply require someone to help you with your company earnings taxes or you have been billed with tax fraud, hire a tax attorney to assist you out.

All about Matthew J. Previte Cpa Pc

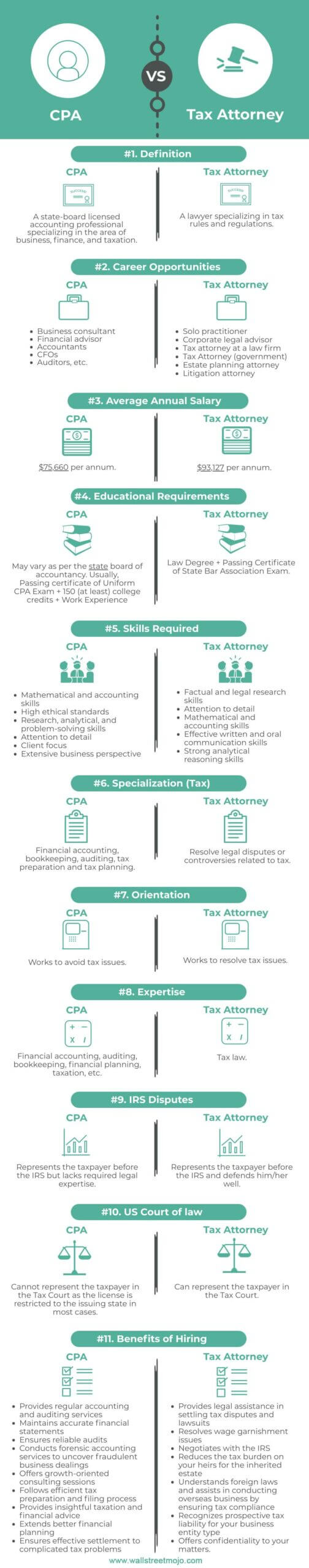

Everybody else not only disapproval dealing with tax obligations, however they can be outright scared of the tax firms, not without reason. There are a couple of concerns that are always on the minds of those that are handling tax troubles, including whether to hire a tax obligation lawyer or a CPA, when to hire a tax obligation attorney, and We wish to aid respond to those questions below, so you recognize what to do if you locate on your own in a "taxing" circumstance.

An attorney can stand for customers prior to the internal revenue service for audits, collections and appeals but so can a CERTIFIED PUBLIC ACCOUNTANT. The big difference here and one you need to maintain in mind is that a tax obligation legal representative can provide attorney-client advantage, meaning your tax lawyer is exempt from being urged to indicate versus you in a law court.

Matthew J. Previte Cpa Pc Fundamentals Explained

Or else, a CPA can indicate versus you even while working for you. Tax lawyers are extra knowledgeable about the numerous tax settlement programs than the majority of Certified public accountants and recognize exactly how to select the very best program for your case and just how to get you qualified for that program. If you are having a problem with the internal revenue service or just questions and problems, you require to employ a tax lawyer.

Tax Court Are under investigation for tax obligation fraud or tax evasion Are under criminal examination by the internal revenue service Another vital time to work with a tax lawyer is when you receive an audit notification from the internal revenue service - IRS Audits in Framingham, Massachusetts. https://www.magcloud.com/user/taxproblemsrus1. An attorney can connect with the IRS in your place, exist during audits, aid bargain negotiations, and maintain you from paying too much as an outcome of the audit

Part of a tax lawyer's task is to stay up to date with it, so you are safeguarded. Your finest source is word of mouth. Ask around for an experienced tax obligation attorney and check the internet for client/customer evaluations. When you interview your option, request added referrals, particularly from customers that had the same problem as your own.

Some Known Incorrect Statements About Matthew J. Previte Cpa Pc

The tax attorney you desire has every one of the ideal qualifications and endorsements. Every one of your concerns have actually been responded to. Federal Tax Liens in Framingham, Massachusetts. Should you employ this tax attorney? If you can pay for the fees, can accept the kind of potential solution supplied, and believe in the tax attorney's ability to assist you, then indeed.

The choice to work with an internal revenue service lawyer is one that must not be taken gently. Lawyers can be incredibly cost-prohibitive and make complex issues unnecessarily when they can be fixed fairly quickly. Generally, I am a huge supporter of self-help lawful options, particularly given the range of informational material that can be located online (including much of what I have released when it come to tax).

Fascination About Matthew J. Previte Cpa Pc

Here is a quick checklist of the issues that I think that an IRS attorney should be worked with for. Crook costs and criminal investigations can damage lives and carry extremely significant repercussions.

Bad guy fees can additionally carry extra civil fines visit the website (well beyond what is common for civil tax matters). These are just some examples of the damage that also just a criminal fee can bring (whether an effective sentence is eventually gotten). My factor is that when anything possibly criminal develops, also if you are simply a prospective witness to the matter, you require an experienced IRS lawyer to represent your passions against the prosecuting company.

Some might quit brief of absolutely nothing to get a sentence. This is one circumstances where you constantly require an IRS attorney enjoying your back. There are many parts of an IRS lawyer's work that are seemingly routine. Most collection matters are dealt with in approximately the exact same method (even though each taxpayer's conditions and objectives are various).

Things about Matthew J. Previte Cpa Pc

Where we make our stripes though gets on technical tax obligation issues, which placed our full ability set to the test. What is a technological tax issue? That is a hard concern to answer, however the most effective method I would describe it are issues that require the specialist judgment of an IRS lawyer to settle effectively.

Anything that has this "truth dependency" as I would certainly call it, you are mosting likely to wish to bring in a lawyer to seek advice from - IRS Seizures in Framingham, Massachusetts. Also if you do not retain the services of that attorney, an expert viewpoint when taking care of technological tax obligation issues can go a long method toward understanding issues and resolving them in a suitable fashion

Report this page